Picture yourself at the helm of an insurance franchise, where agents come and go, regulations seem to change overnight, and keeping training consistent across every branch feels like chasing the horizon. For many managers, this isn’t some far-fetched worry — it’s just another day at the office. The right tools, however, could turn these daily headaches into your biggest strengths.

Boost Standardization, Training & Performance Tracking with Vedubox

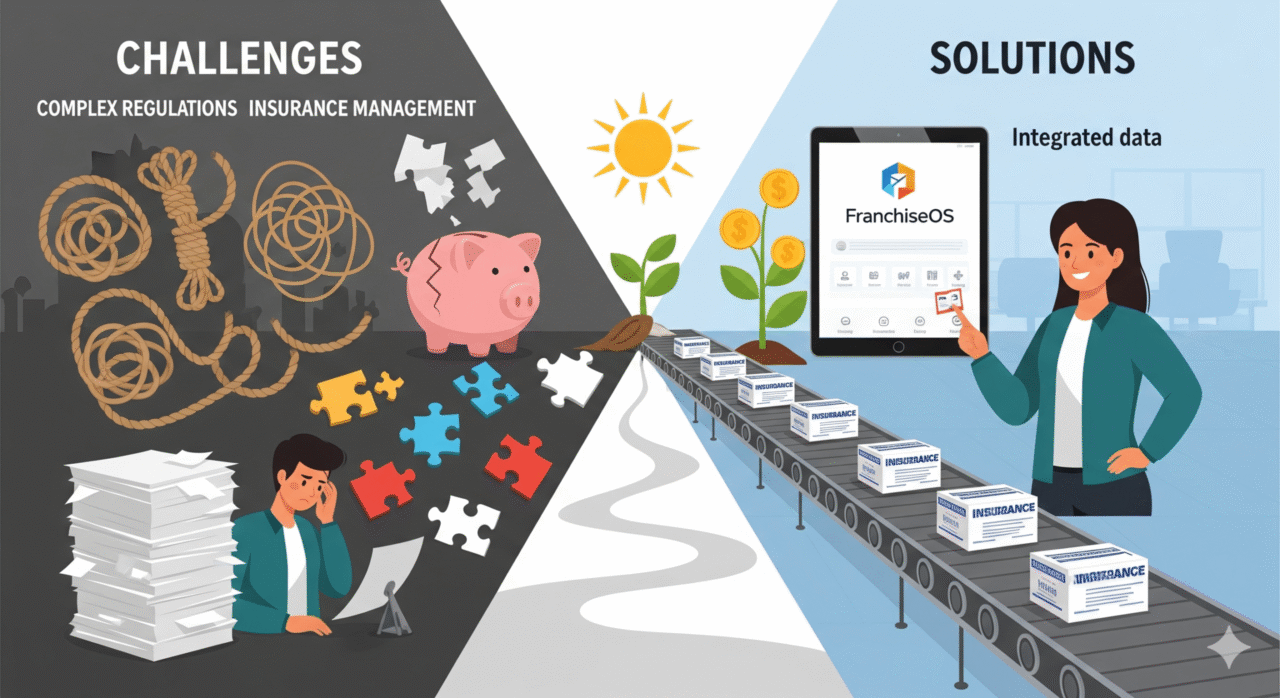

Franchising is on the rise in the insurance world, but growing this way brings its own set of hurdles. Fragmented operations, tangled regulations, uneven service, and communication snags are just the beginning. Ensuring every branch operates at the same level, quickly getting new agents up to speed, and keeping everyone aligned with your company’s vision can stretch your resources thin. If these challenges aren’t tackled head-on, they can chip away at customer trust, slow you down, and put your brand’s reputation at risk.

Common Franchise Management Challenges in the Insurance Industry

You need a smart, modern approach to training your team to overcome these challenges. The right technology, like a learning management system built for insurance, can help you steer through the rough patches, stay on top of compliance, and set the stage for real growth.

1. Inconsistent Service Quality

Franchise representatives’ differences in experience, product knowledge, and customer communication skills lead to an inconsistent brand experience. A consistent brand presentation can increase revenue by up to 23 percent, according to research by Lucidpress.

Vedubox brings everyone up to speed with online courses, live sessions, and hands-on assessments. Add a dash of gamification to keep things lively and help lessons stick. With Vedubox as your training headquarters, every agent — no matter where they are — learns what matters most: your brand’s values, your products, and the service that sets you apart

2. Poor Internal Communication and Information Flow

Updates about new products, campaigns, or regulations may not reach all franchisees simultaneously, which creates knowledge gaps and operational delays.

You can resolve this issue by getting the word out fast with instant announcements, shared documents, and live broadcasts. You can see exactly who’s in the loop, so nothing slips through the cracks. That way, every branch stays connected and up to date.

3. The Relentless Battle Against Talent Turnover & Skill Gaps

High attrition rates among agents and difficulty in attracting new talent significantly impact productivity and recruitment costs. Industry reports suggest the annual turnover rate for insurance agents can exceed 20 percent, with replacing an employee costing 6 to 9 months of that employee’s salary.

Handing new agents everything they need from day one is critical to tracking their progress without lifting a finger and ensuring they’re ready to hit the ground running. Vedubox makes it easy to roll out onboarding that’s both standardized and tailored, so every recruit gets the right start. Plus, ongoing training keeps your team sharp and helps agents see a future with you.

4. Mastering the Maze of Compliance & Regulatory Requirements

The ever-evolving landscape of regulations, licensing requirements, and compliance audits poses a significant burden and risk. The National Association of Insurance Commissioners (NAIC) frequently updates model laws, creating a constant need for updated training. Non-compliance can lead to substantial fines, reputational damage, and even license revocation.

Vedubox builds and delivers compliance modules, tracks completion, and generates reports, allowing you to ensure full coverage and share regulatory updates and training with every branch instantly.

5. Lack of Performance Tracking & Analytics

It’s hard to track franchisee activity and evaluate training effectiveness across the network, making it difficult to identify specific skill gaps and deliver targeted training that demonstrably improves performance. Companies that invest in comprehensive training programs report a 24% higher profit margin than those with lower investment, according to Association for Talent Development research.

With Vedubox, you gain granular insights into individual agent performance and training gaps. Its powerful analytics allow you to assign targeted modules and track progress, ensuring your insurance company employee training directly translates into enhanced sales and productivity. This also enables just-in-time learning, providing immediate access to crucial information when agents need it most.

Vedubox: Your Strategic Partner in Overcoming Insurance Franchise Challenges

Spotting the challenges is just the first step. The real difference comes from using the right tools to tackle them. Vedubox is built with the insurance world in mind, ready to meet your needs head-on.

What Makes Vedubox Different?

- 100% cloud-based — no installation needed, offering rapid deployment and accessibility.

- Customizable Content Creation & Delivery: Create and manage unique courses tailored to various roles and products, ensuring your insurance company’s employee training remains relevant.

- Powerful Tracking & Reporting: Comprehensive dashboards for monitoring insurance company training requirements completion, compliance, and individual progress.

- Multi-Tenancy/Multi-Franchise Support: Seamlessly manage training across multiple independent franchise entities.

- Mobile Learning (Anytime, Anywhere Access): Empower agents to learn on the go, crucial for a field-based workforce.

- Automated Certifications & Reminders: Ensure licenses and compliance training are always up to date.

- Scalability: Designed to grow with your franchise network, supporting your expansion without compromise.

- Seamless Zoom, Google Workspace, and Vimeo integration.

- White Label (customized with your brand and corporate identity).

- Multilingual support.

- E-commerce & customer training modules.

Digitize Your Insurance Franchise Network Today

Running an insurance franchise isn’t easy. From retaining top talent to staying compliant and establishing a strong brand, the challenges are real — but they can be overcome. Smart, focused training with the right LMS can make a difference.

Choosing the right LMS equals an investment in your future. It helps your team grow, keeps you ahead of the curve, and protects your edge in a tough market.

Explore Vedubox’s potential to unlock your franchise’s full potential with intelligent, scalable learning solutions.